The recently signed Inflation Reduction Act (IRA) provides significant investment to reduce the effects of US carbon pollution in the face of the current climate crisis. To do this, the act includes tax credits and rebates for Miami homeowners who upgrade their homes to make them more energy efficient, which can also lower your energy bill!

IRA tax credits and rebates: how much can I save?

Homeowners in the Miami area who invest in energy efficient HVAC upgrades have the opportunity to save a whopping $17,000 in tax credits and rebates through the IRA. Use this handy savings calculator on Rewiring America’s website to estimate how much money you might save on your utility bills. To see what energy-efficient home updates might be right for your home, contact the HVAC pros at Direct Air at 786-875-3093.

Inflation Reduction Act tax credits

We all like finding ways to save money, especially when it comes to taxes. Miami homeowners who purchase and install energy-saving upgrades to their homes, such as energy-efficient doors and windows, air conditioners, furnaces, heat pumps, and more, will be eligible for tax credits under the Inflation Reduction Act.

Tax credit for energy-efficient home improvements (25C)

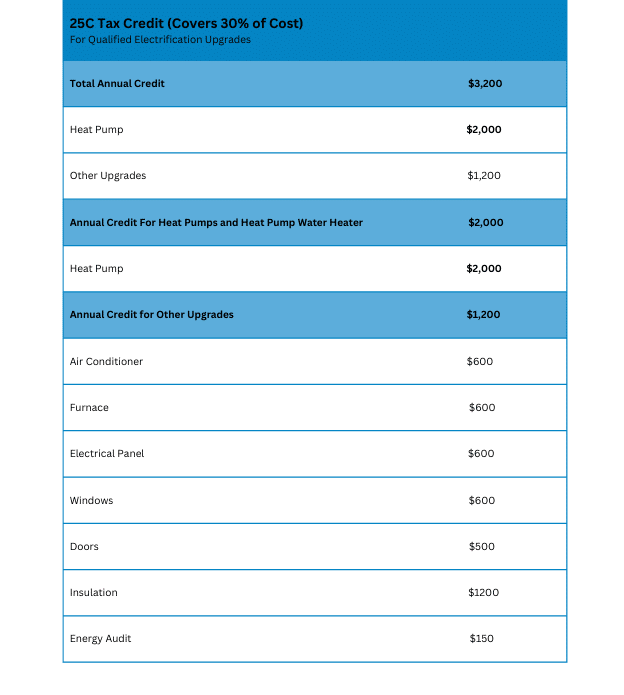

The Energy Efficient Home Improvement Tax Credit included in the Inflation Reduction Act is an expansion of the 25C tax credit, which allows homeowners to deduct up to 30% of the cost of certain energy-efficient home improvements, up to $3,200 per year. Check out the list below to see what appliances and upgrades are eligible for this tax credit. The AC professionals at Direct Air are standing by when you decide to invest in energy-efficient home upgrades or replacements.

It’s important to remember that these tax credits are not up-front savings on the purchase of new equipment or appliances. They’ll be added to your tax credit amount when you file your 2023 taxes next year.

NOTE: While we at Direct Air are happy to provide information on qualifying appliances, but we cannot provide any tax or other financial advice. Please contact your tax professional if you need help filing when the time comes.

Any new appliances or home upgrades you make must meet certain requirements in order to qualify for the 25C tax credit Direct Air can help you find qualified equipment that will save you money and qualify for the tax credit—give us a call at 786-875-3093. Check out this chart to see how much you can save on your utility bills each year!

Find a list of Energy Efficient Home Improvement Tax Credit and eligible appliances here.

Eligibility for the IRA 25C tax credit

All homeowners in Miami, FL are eligible for the Energy Efficient Home Improvement Tax Credit, which applies to any qualifying equipment you install or upgrades you make in 2023 and beyond—the credit resets each year. Annual caps for these tax credits are $1200 per household per year (without heat pumps), or $2000 for upgrade that include heat pumps. The total cap per household per year is $3200. Now is a great time to undertake planned home improvements and take advantage of these tax savings! Should you need assistance with products or installation, please feel free to reach out to Direct Air at 786-875-3093.

Claiming your Inflation Reduction Act tax credits

Direct Air can provide you with the documentation your regarding your new qualified energy efficient upgrades so you can claim your tax credits. Give us a call at 786-875-3093 to learn more.

Use this IRA savings estimation calculator to find out how much you can save on taxes by taking advantage of these credits.

Inflation Reduction Act home improvement rebates

Homeowners in Miami, FL can also benefit from rebates that are included in the IRA. While tax credits are available right now, rebates will be available toward the end of 2023.

HEEHRA (High Efficiency Electric Home Rebate Act)

The High Efficiency Electric Home Rebate Act (HEEHRA) provides rebates of up to $14,000 per year for low- to moderate-income households that upgrade to energy-efficient electric appliances. Eligible households must make an income below the 150% area median income. To get all the information about HEEHRA rebate program, check the chart below.

In most cases, you will receive a rebate when you purchase the appliance under the HEEHRA. If you have questions about eligibility or to see if you qualify for these rebates, contact Direct Air at 786-875-3093 for advice on purchasing and installing any of these new appliances.

Home Owners Managing Energy Savings (HOMES) Rebate

The HOMES rebate program encourages energy savings by reimbursing homeowners for whole-house energy improvements. That means you will be able to earn more money back if you install equipment like heat pumps and make electrical upgrades that reduce your home’s energy consumption.

With the HOMES program, the more energy you save, the bigger the rebate. Households that reduce energy use by 20%-35% can save $2000 to $8000!

HOMES rebates are available to all households, but the rebate amount is doubled for low- and moderate-income households. In addition, up to 80% of project costs will be covered by the program.

Most of the rebates offered under the Inflation Reduction Act will be available by the end of 2023, depending on Florida guidelines and Department of Energy regulations. In order to see if rebates are available when you’re ready to purchase, contact Direct Air at 786-875-3093.

Save energy, save money

The Inflation Reduction Act was crafted to help control the costs associated with the overuse of fossil fuels, as well as to reduce pollution and promote cleaner energy solutions throughout the United States. Homeowners can ease their energy spending, reduce their tax liability, and receive a financial return when purchasing energy-efficient appliances and other home upgrades.

At Direct Air we are happy to answer all your questions regarding potential home improvements or the Inflation Reduction Act; just give us a call at 786-875-3093.

(NOTE: We are not tax professionals and can’t offer financial advice. Please contact your tax preparation professional or the IRS website for help in filing your taxes and claiming any credits.)

Frequently Asked Questions

What are the differences between tax credits and rebates under the Inflation Reduction Act?

If you upgrade your home, you can claim the tax credits included in your IRA on your tax return, which reduces your tax liability. With the 25C tax credit, customers can receive an annual tax incentive of up to $3200 with the IRA. The tax credit can be claimed for both this year and next year if you install a heat pump air conditioning system or a heat pump water heater in your home.

A rebate is a type of upfront savings that is applied at the point of sale. The service provider is responsible for handling the paperwork and processing the rebate.

Can rebates be applied retroactively?

Rebates will be retroactive at the discretion of each state, according to state energy offices.

Is it possible to combine rebates and tax credits?

HOMES and HEERHA rebates cannot be used for the same upgrade, but they can be combined for separate upgrades, such as upgrading your water heater with HEERHA and upgrading your heat pump with HOMES.

Inflation Reduction Act tax credits can still be claimed while getting HEEHRA and HOMES rebates.

What should I do first?

Whether you need heat pumps, electrical upgrades, energy efficient plumbing, or any other type of inflation reduction act incentive, Direct Air’s trusted experts in Miami, FL know all the ins and outs of the Inflation Reduction Act incentives and can provide you with all the information you need to apply for the tax credits or rebates you qualify for. Call us today at 786-875-3093 to schedule an appointment or ask any questions.