The Inflation Reduction Act (IRA) offers significant tax credits and rebates for homeowners who want to make energy efficient electrical home upgrades. You can save upwards of $17,000 per year with tax credits and rebates included in the IRA. In addition, you can save on your utility bills by replacing old electrical systems. In this blog we will talk about some of the upgrades Miami-area homeowners may want to consider and how much money these changes can save this year and beyond.

Electrical panel updates

Electrical panels (also referred to as panelboard, sub panelboard, or breaker boxes) are connected to your home’s main power supply and they distribute electricity to various parts of your home. These are easy to take for granted as long as they are working properly; however, if they fail, you have a big problem on your hands. Fortunately, there are simple upgrades you can make to keep your home safe, improve your energy efficiency, and save money.

If your home was built in the last 25 years or before, the electrical panel is probably part of the original wiring, which means it’s probably time for an upgrade. Today’s households use more electricity, and older homes may need upgraded panels to keep up. Having up to date electrical panels in your home is an important way to keep your family safe, and to save money and energy. Call Direct Heating & Cooling, LLC at 786-875-3097 to get an expert assessment of the panel upgrades that are best for your home.

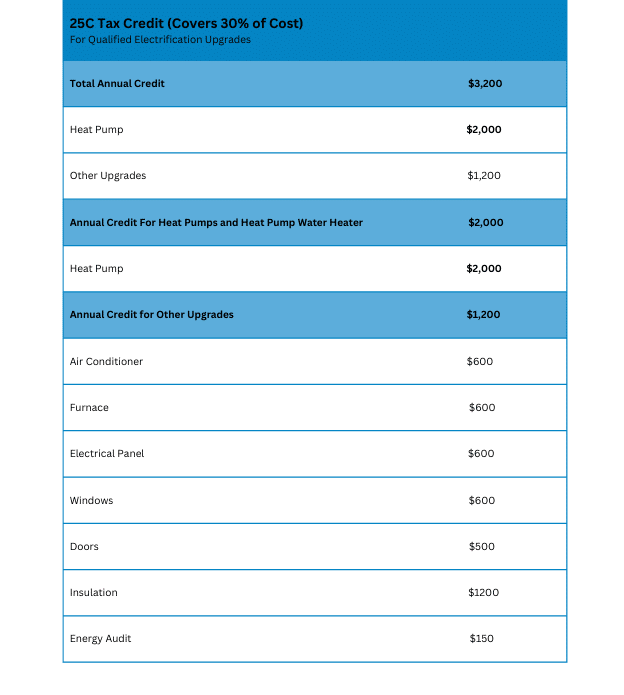

IRA tax credit for electrical panels: The Inflation Reduction Act provides a tax credit of up to $600 for homeowners who upgrade their electrical panels in conjunction with any qualified energy property or upgrade covered in Energy Efficient Home Improvement Tax Credit (25C). See the chart below for more information on this tax credit.

To see how much you can save by making energy efficient changes to your home, check out this great savings calculator from Rewiring America.

IRA 2023 Tax Credits for electrical and plumbing upgrades

Energy Efficiency Home Improvement Tax Credit (25C)

The 25C tax credit, or Energy Efficient Home Improvement Tax Credit, allows homeowners to deduct up to 30% of the cost of certain home improvements, with a max of $3,200 per year. Please note that new appliance installations or home upgrades must meet certain requirements to be eligible for the tax credit. Find full details about how the Energy Efficient Home Improvement Tax Credit works here.

Direct Heating & Cooling, LLC can provide you with documentation on your new upgrades to claim these credits when you work with us for electrical and plumbing upgrades. However, we cannot offer financial advice. Please contact your accountant or tax professional for assistance when it’s time to file.

IRA rebates for electrical upgrades

The Inflation Reduction Act also includes rebates on the purchase of new energy efficient electrical appliances and installation. These rebates will be available later in 2023.

HOMES rebate

The HOMES rebate program rewards homeowners who make whole-house energy improvements. That means if you make electrical upgrades that reduce your home’s energy consumption, you will be able to earn more money back.

For example, depending on where you live and your median family income, you can save up to $8000 when you cut your energy use by 35 percent! All Miami homeowners qualify for the HOMES Rebate, but low- and medium-income households can get more back. This program provides rebates based on the percentage of energy savings.

HEEHRA rebate

The High-Efficiency Electric Home Rebate Act (HEEHRA) offers as much as $14,000 per year in discounts on the purchase of energy-efficient appliances. Depending on your household income, HEEHRA rebates can cover anywhere from 50% to 100% of qualifying costs, up to $14,000! Note that these are discounts, not tax credits.

NOTE: The HOMES rebate cannot be combined with the HEEHRA rebates (see below), but can be combined with the Inflation Reduction Act tax credits.

Contact Direct Heating & Cooling, LLC today to see what options are most appropriate for your home. Give us a call at 786-875-3097.

Direct Heating & Cooling, LLC has the answers you need.

Miami-area homeowners trust the experts at Direct Heating & Cooling, LLC for professional guidance and installation. Whether you’re looking to make electrical upgrades or are looking for expert advice about these kinds of projects, Direct Heating & Cooling, LLC can help you decide on the best option for your home.

Contact us today at 786-875-3097 to make an appointment or ask us questions you may have about how you can take advantage of the Inflation Reduction Act.

NOTE: Direct Heating & Cooling, LLC Air are not financial or tax experts and cannot offer advice in these areas. Please contact a tax professional with any questions.